Small businesses in Italy looking to export their products to the United States may occasionally encounter difficulties with payment recovery from US-based customers. Understanding the intricacies of export payment recovery is crucial for maintaining financial stability and ensuring successful international trade. This article delves into a structured approach to payment recovery, outlining a three-phase recovery system, initial recovery efforts, legal assistance, decision-making on litigation, and understanding fee structures for collection services.

Key Takeaways

- A three-phase recovery system is employed to maximize the chances of successful payment recovery from US-based debtors, starting with swift initial contact and potentially escalating to legal action.

- Immediate action within the first 24 hours of non-payment is critical, including sending letters, skip-tracing, and persistent communication attempts to engage the debtor.

- Legal escalation involves attorney-based recovery tactics with demand letters and persistent communication, with a clear understanding of the implications of legal recommendations.

- Decisions on litigation should be made after evaluating the viability of recovery and understanding the costs and process of initiating legal action, including options after unsuccessful attempts.

- Fee structures for collection services are competitive and vary based on claim volume, account age, amount, and whether the account has been placed with an attorney.

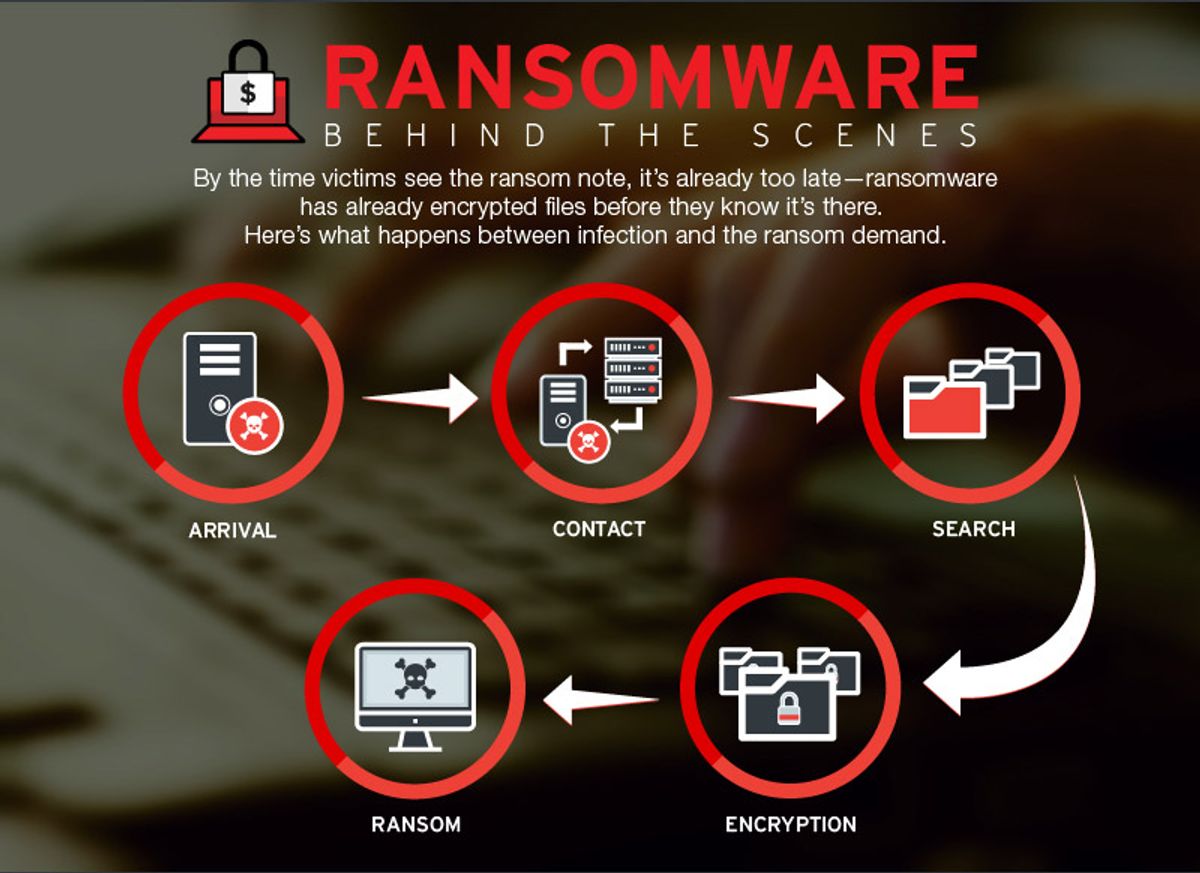

Understanding the Three-Phase Recovery System

Phase One: Initial Contact and Debt Investigation

The first 24 hours are critical in the debt recovery process. Immediate action is taken to send out the initial contact letter and to conduct a thorough investigation of the debtor’s financial status and contact information. Persistent attempts to reach a resolution through various communication channels are essential.

- Initial contact letter sent via US Mail

- Comprehensive skip-tracing and debtor investigation

- Daily contact attempts for 30 to 60 days

The goal is to establish communication and negotiate a resolution before escalating to legal action. The three-phase recovery system is designed to adapt to the unique challenges of Italy-USA trade relations.

If these efforts do not yield results, the case transitions to Phase Two, where legal expertise comes into play. The focus remains on recovery, with the understanding that each phase intensifies the approach.

Phase Two: Legal Escalation and Attorney Involvement

When initial recovery efforts fail, the case escalates to legal intervention. An attorney within the debtor’s jurisdiction is engaged, marking a significant shift in the recovery process. The attorney’s first action is to draft a demand letter, leveraging the weight of legal letterhead to underscore the seriousness of the situation.

- Immediate drafting of a demand letter

- Persistent attempts to contact the debtor

- Preparation for potential litigation

The attorney’s persistent communication efforts include phone calls and additional letters. If these attempts do not yield results, a detailed report outlining the challenges and recommended next steps is provided to the client. This may include proceeding to litigation or case closure, depending on the feasibility of recovery.

The transition to legal means is a critical juncture in the recovery process, necessitating a clear understanding of the implications and potential outcomes.

Understanding the nuances of this phase is crucial for small businesses seeking to recover payments from US clients. The strategy employed here can significantly influence the overall success of the debt recovery effort.

Phase Three: Final Recommendations and Litigation Options

At the culmination of the 3-Phase Recovery System, a decisive moment arrives. Your choice will shape the outcome. If the odds of recovery are slim, we advise case closure—no fees owed. Conversely, choosing litigation incurs upfront costs, but with a no-win, no-fee assurance.

Deciding against legal action? Withdraw at no cost, or opt for continued standard collection efforts. If litigation is your path, prepare for initial legal expenses, typically $600-$700. Our affiliated attorney will then champion your cause in court.

Our fee structure is clear and competitive, aligning with the age and volume of claims. Remember, if litigation doesn’t succeed, you owe us nothing. The decision is yours—weigh it with care.

Navigating the Initial Recovery Efforts

The Importance of Swift Action Within 24 Hours

Time is of the essence when recovering export payments. Acting within the first 24 hours can significantly increase the likelihood of successful recovery. Immediate actions set the tone for the debtor, indicating a serious and professional approach.

- Initial Contact: Send the first of four letters via US Mail.

- Debtor Investigation: Perform comprehensive skip-tracing to gather financial and contact information.

- Persistent Communication: Utilize calls, emails, text messages, and faxes to reach a resolution.

Daily attempts to contact the debtor during the initial phase demonstrate commitment to recovery. If these efforts do not yield results, the case escalates to the next phase, involving legal action.

Understanding the debtor’s situation quickly allows for strategic decisions. It’s not just about persistence; it’s about smart, targeted efforts that pave the way for the next steps in the recovery process.

Comprehensive Skip-Tracing and Debtor Investigation

Once the initial contact is made, a thorough skip-tracing and debtor investigation ensues. This critical step ensures that all available financial and contact information is unearthed, providing a solid foundation for recovery efforts. Persistent and strategic pursuit is key to locating elusive debtors and assessing their ability to pay.

- The process begins with a deep dive into the debtor’s financial background.

- Advanced tools and databases are utilized to track down current contact details.

- A multi-channel approach is adopted, involving phone calls, emails, text messages, and faxes.

The goal is to gather comprehensive data that informs the strategy for recovery. This phase is relentless, with daily attempts to reach the debtor for the first 30 to 60 days. If this phase does not yield a resolution, the case escalates to legal involvement.

Understanding the debtor’s assets and liabilities is crucial for determining the next steps. If the likelihood of recovery is low, a recommendation for case closure may be made, ensuring no further resources are wasted. However, if the prospects are promising, the path to litigation is considered, with all associated costs and implications clearly outlined.

Persistent Contact Attempts: Calls, Emails, and More

In the relentless pursuit of debt recovery, persistent contact attempts are crucial. The initial phase involves a barrage of communication strategies aimed at the debtor. Daily attempts are made, utilizing a mix of phone calls, emails, text messages, and faxes, to establish a resolution.

Persistence is key. The first 30 to 60 days are critical, with our collectors making daily contact attempts.

The strategy is clear: keep the pressure up. The goal is to make the debtor aware of the seriousness of their situation and the intent of the business to recover what is owed. Here’s a snapshot of the contact frequency:

- Day 1-30: Daily phone calls and emails

- Day 31-60: Follow-up calls every other day; weekly emails

- Beyond 60 days: Escalate to legal action if necessary

The escalation of communication is not just about quantity, but also about increasing the intensity and formality of the messages as time progresses. If these efforts do not yield results, the case moves to Phase Two, involving legal escalation.

Engaging Legal Assistance for Payment Recovery

Transition to Attorney-Based Recovery

When initial recovery efforts falter, the baton is passed to a specialized attorney. The shift to legal professionals marks a critical juncture in the recovery process. Attorneys bring a formal tone and the weight of the law to your demands.

- Immediate drafting of demand letters on law firm letterhead

- Persistent debtor contact through calls and legal correspondence

- Escalation of communication frequency and urgency

The involvement of an attorney often serves as a wake-up call to debtors, signaling the seriousness of the situation.

This phase is designed to apply pressure and elicit a response. If this fails to yield results, the next step is a clear and detailed explanation of the potential legal pathways and their implications.

Drafting Demand Letters and Persistent Communication

Once legal escalation is deemed necessary, the drafting of demand letters becomes a pivotal step. The tone and content of these letters must convey urgency and the seriousness of the situation. They serve as a formal request for payment and a warning of potential legal action if the debt remains unsettled.

- The initial demand letter is sent on attorney letterhead, emphasizing the legal weight behind the request.

- Subsequent communications maintain pressure, with regular follow-ups to ensure the debtor is aware of the impending consequences.

- A strategic mix of phone calls, emails, and letters is employed to maximize the chances of a response.

The goal is to negotiate a settlement before litigation becomes necessary, saving time and resources for all parties involved.

Remember, persistence is key in this phase. Each communication is an opportunity to clarify the debt obligations and to outline the potential for legal recourse. It’s essential to maintain a balance between firmness and the possibility for amicable resolution, keeping in mind the ultimate aim of recovering the owed amount.

Understanding the Implications of Legal Recommendations

When faced with unpaid invoices, small businesses must weigh the potential outcomes of legal action. Deciding whether to litigate or withdraw a claim is pivotal. Legal action options for recovering unpaid invoices include proceeding with litigation by paying upfront costs or withdrawing the claim with no extra fees. Standard collection activities can also be pursued.

Legal costs can be a significant factor in your decision. Upfront fees, such as court costs and filing fees, typically range from $600 to $700, depending on the debtor’s jurisdiction. These are necessary to initiate a lawsuit for the recovery of all monies owed.

Should litigation prove unsuccessful, the case will be closed without additional charges from the firm or affiliated attorney. This assurance provides a safety net, mitigating the financial risk involved in legal proceedings.

It’s essential to understand that the choice to litigate should be based on a thorough investigation of the debtor’s assets and the likelihood of recovery. If the probability of success is low, it may be more prudent to close the case or continue with standard collection efforts.

Making Decisions on Litigation and Case Closure

Evaluating the Viability of Recovery

Before proceeding with costly legal actions, a critical assessment of the debt recovery’s viability is essential. Assessing the debtor’s assets and the surrounding facts of the case provides a clear picture of the likelihood of successful recovery. If the probability is low, it may be prudent to consider case closure, avoiding unnecessary expenses.

Recovery is not always guaranteed, and the decision to litigate should be weighed against the potential return. Here’s a quick checklist to guide the evaluation process:

- Review the debtor’s financial status and asset ownership.

- Analyze the age and size of the debt.

- Consider previous recovery attempts and their outcomes.

- Estimate the costs of litigation versus the debt amount.

When the chance of recovery is slim, cutting losses early can save time and resources.

Finally, if the decision is to move forward with litigation, be prepared for the upfront legal costs, which typically range from $600 to $700. This investment should only be made with a reasonable expectation of debt recovery.

The Costs and Process of Initiating Legal Action

When the decision to pursue litigation is made, understanding the financial implications is paramount. Upfront legal costs are a reality, typically ranging from $600 to $700, which cover court costs and filing fees. These expenses are necessary to propel the case into the legal system, where an affiliated attorney will represent your interests.

Transparency in fees and processes is crucial, especially considering the non-payment risks in sectors like leather goods and chemicals. A robust recovery system with clear phases and costs ensures businesses are not left in the dark.

The decision to litigate is significant; it’s not just about the potential recovery, but also about the readiness to invest in the process.

Here’s a quick breakdown of potential costs:

- Upfront legal costs (court costs, filing fees): $600 – $700

- Collection rates (post-recovery): 30% – 50% depending on claim specifics

Should litigation not result in recovery, the case is closed with no additional fees owed to the firm or attorney. This no-recovery, no-fee structure is designed to align the interests of the business with those of the collection service.

Options After Unsuccessful Litigation Attempts

When litigation fails to yield results, it’s time to reassess. Closure of the case may be the most pragmatic option if the likelihood of recovery remains low. This decision comes with no additional cost to you from our firm or affiliated attorney.

Alternative strategies may still be on the table:

- Continued standard collection activities (calls, emails, faxes, etc.)

- Re-evaluation of the debtor’s assets and financial status

- Exploring the possibility of a negotiated settlement

It’s essential to weigh the costs and potential benefits of ongoing efforts against the backdrop of previous unsuccessful attempts.

Remember, our fee structure is designed to align with your success in recovery. We only charge a percentage of the amount collected, ensuring our interests are directly tied to your results.

Fee Structures and Rates for Collection Services

Competitive Collection Rates Tailored to Claim Volume

Small businesses exporting from Italy to the US can benefit from tailored collection rates that adjust based on the volume of claims. The more claims you submit, the more cost-effective the service becomes. This incentivizes early and bulk submissions, aligning with best practices for asset protection and efficient debt recovery.

For instance:

- 1-9 claims: Rates vary from 30% to 50% of the amount collected, depending on account age and size.

- 10+ claims: Enjoy reduced rates, dropping to as low as 27% for newer accounts.

It’s crucial to understand that collection rates for US Importers depend on early claims submission. This approach not only maximizes recovery chances but also minimizes the financial impact on your business.

Remember, the goal is to recover your payments without incurring excessive costs. By submitting claims promptly and in volume, you can leverage competitive rates that reflect the scale of your export operations.

Rate Variations Based on Account Age and Amount

The age and size of an account significantly influence collection rates. Newer accounts often incur lower fees, reflecting the higher likelihood of successful recovery. Conversely, older accounts, especially those exceeding a year, typically attract higher rates due to the increased difficulty in collection.

Italian food exporters should be aware that accounts under $1000 also carry a premium rate, given the disproportionate effort to value ratio. Timely action can mitigate these costs, emphasizing the importance of swift debt recovery strategies.

The fee structure is designed to align the collection agency’s efforts with the client’s recovery success.

Here’s a quick breakdown of the rates:

- Accounts under 1 year: 30% (1-9 claims) or 27% (10+ claims)

- Accounts over 1 year: 40% (1-9 claims) or 35% (10+ claims)

- Accounts under $1000: 50%, regardless of claim volume

- Accounts requiring attorney involvement: 50%, reflecting the legal complexities involved.

Understanding Attorney Placement Fees

Attorney placement fees are a critical component of the debt recovery process for Italian exporters dealing with US clients. These fees are contingent on the placement of your claim with a legal professional and are designed to cover the initial legal costs, such as court costs and filing fees. These fees typically range from $600.00 to $700.00, depending on the debtor’s jurisdiction.

Jurisdictional variations can significantly impact the recovery process, making it essential to understand the implications of these fees upfront. If litigation is recommended and you decide to proceed, you will be required to pay these fees to initiate legal action. However, if the litigation attempts are unsuccessful, the case will be closed, and you will owe nothing further.

Here’s a quick breakdown of the fee structure:

- Accounts placed with an attorney: 50% of the amount collected.

- Competitive rates are tailored based on claim volume and account age.

Effective communication and legal actions are crucial for debt recovery, and understanding these fees is part of that process. Remember, swift action and a thorough investigation of the debtor’s assets can guide your decision on whether to pursue litigation.

Navigating the complexities of debt recovery can be challenging, but with Debt Collectors International, you have a partner that understands the intricacies of fee structures and rates for collection services. Our experienced team is committed to providing you with tailored solutions that fit your unique needs. Whether you’re interested in our No Recovery No Fee options, flat fee collections with InvoiceGuard, or specialized industry services, we’re here to help you maximize your recoveries. Don’t let unpaid debts disrupt your business—visit our website today to get a free rate quote and learn more about our effective collection strategies.

Frequently Asked Questions

What actions are taken within 24 hours of placing an account for recovery?

Within 24 hours, the first of four letters is sent to the debtor, the case is skip-traced and investigated for financial and contact information, and our collector begins attempts to contact the debtor through various communication methods, making daily attempts for the first 30 to 60 days.

What happens if initial recovery efforts fail in Phase One?

If all attempts to resolve the account fail in Phase One, the case is escalated to Phase Two, where it is forwarded to one of our affiliated attorneys within the debtor’s jurisdiction for legal escalation.

What does the attorney do upon receiving the case in Phase Two?

The attorney will draft demand letters on their law firm letterhead and attempt to contact the debtor via telephone, in addition to sending a series of letters demanding payment.

What are the possible recommendations after Phase Two?

If recovery is deemed unlikely after a thorough investigation, we recommend case closure at no cost. If litigation is recommended, you can choose to proceed with legal action or continue standard collection activity.

What are the upfront legal costs if I decide to proceed with litigation?

The upfront legal costs for litigation typically range from $600.00 to $700.00, covering court costs, filing fees, and other related expenses, depending on the debtor’s jurisdiction.

How are collection rates determined?

Collection rates are competitive and tailored, depending on the number of claims submitted and other factors such as the age of the account, the amount owed, and whether the account is placed with an attorney. Rates vary from 27% to 50% of the amount collected.